What Makes a Great Investment Property in NYC?

Key Considerations for NYC Real Estate Investment

Investing in New York City real estate can be a lucrative venture, but it requires careful consideration and strategic planning. With its dynamic market, unique neighborhoods, and ever-changing trends, the city offers a wealth of opportunities for investors. Whether you're considering a NYC condo investment or looking for multifamily properties, here are essential factors that contribute to a great investment property in NYC.

Moving to NYC?

1. Location, Location, Location

In the world of real estate, location is paramount. The success of your NYC real estate investment often hinges on the neighborhood you choose. Look for areas with strong demand and growth potential, such as:

- Proximity to Public Transport: Properties near subway stations and bus stops tend to attract more tenants, making them ideal for rental investments.

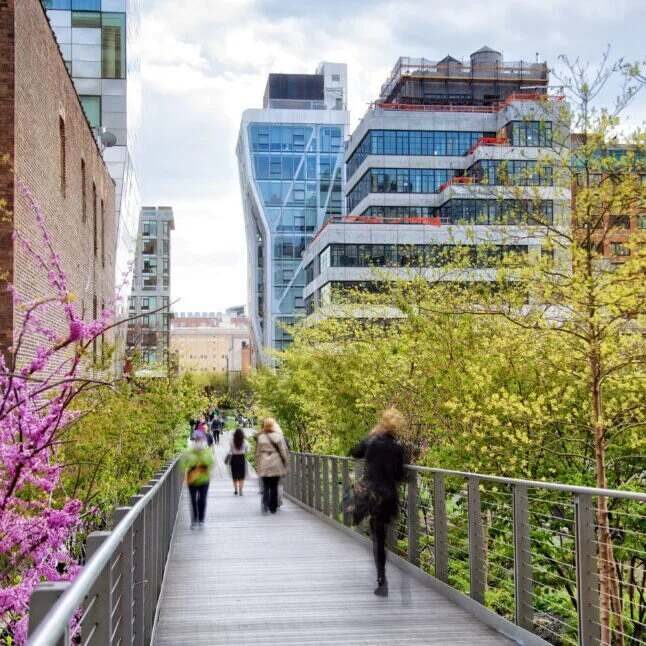

- Access to Amenities: Nearby restaurants, parks, schools, and shopping centers can significantly enhance property appeal.

- Up-and-Coming Neighborhoods: Emerging neighborhoods may offer lower entry prices and the potential for significant appreciation over time.

2. Property Type Matters

The type of property you invest in will greatly impact your returns. Different property types come with unique advantages and challenges:

- Condos vs. Co-ops: NYC condo investments often allow for more flexibility in renting, as condos typically have fewer restrictions compared to co-ops. Additionally, condos may provide amenities that appeal to renters, such as gyms and rooftop terraces.

- Multifamily Buildings: Investing in multifamily properties can offer multiple income streams. Owning several units allows for diversification and can help mitigate risks associated with vacancies.

- Commercial Properties: If you’re looking for higher returns, consider commercial real estate, which often provides longer lease terms and potentially higher rental yields.

3. Understand the Financials

Before committing to any property investment for sale, it’s essential to analyze the financial aspects. This includes:

- Cash Flow Analysis: Calculate potential rental income against operating expenses, such as property management fees, maintenance, and taxes. Positive cash flow is critical for a sustainable investment.

- Return on Investment (ROI): Assess your expected ROI to ensure it meets your financial goals. Look at both short-term gains from rental income and long-term appreciation.

- Financing Options: Explore mortgage options and understand the financing terms available for your investment property. Low-interest rates can significantly improve your cash flow.

4. Consider the Rental Market

Understanding the rental market is vital for successful property investment. Research current rental rates in your target neighborhood to ensure your investment aligns with market expectations.

- Tenant Demographics: Consider who your potential renters are. Young professionals may prefer modern amenities, while families might prioritize space and access to schools.

- Vacancy Rates: High vacancy rates in a neighborhood can indicate an oversupply of rental properties or a lack of demand. Focus on areas with low vacancy rates to enhance your investment's stability.

5. Long-Term Value and Appreciation

Real estate is often viewed as a long-term investment, and understanding the factors that contribute to property appreciation is crucial. Look for:

- Economic Development: Areas undergoing economic growth, such as new businesses or infrastructure projects, can increase property values over time.

- Regulatory Changes: Stay informed about local laws and regulations that could impact property values, including zoning changes and rent stabilization laws.

A great investment property in NYC requires careful analysis of location, property type, financials, and market trends. Whether you're considering a NYC condo investment or exploring multifamily options, understanding what makes a property valuable is essential for success. By focusing on these key considerations, you can confidently navigate the NYC real estate investment landscape and make informed decisions about buying an apartment and renting it out for maximum returns. Investing wisely in an investment property in NYC can lead to significant financial gains in one of the world’s most dynamic real estate markets.