Renting vs. Buying in NYC: How Mortgage Calculators Can Help You Decide

New York City presents a unique challenge when deciding whether to rent or buy a home. The decision is complex, influenced by various factors such as financial stability, long-term plans, and the unpredictable nature of the NYC real estate market.

In this guide, let’s help you ease your way into its decision. We’ll look at some of the important pros and cons of renting vs. buying in NYC and then at how mortgage calculators can significantly improve decision-making when deciding whether to rent or buy in NYC.

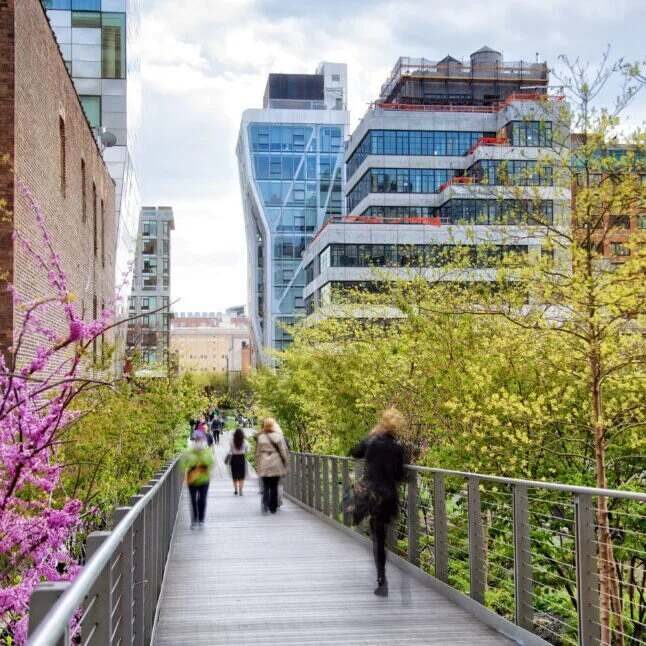

The NYC Real Estate Landscape

Before diving into the specifics of renting vs. buying in NYC, it’s essential to understand the city's real estate landscape. NYC is known for its high property prices and competitive rental market.

According to the latest reports, the median home price in Manhattan is approximately $1.1 million; in Brooklyn, it's around $850,000. On the other hand, the median rent for a one-bedroom apartment in Manhattan hovers around $3,500 per month.

But should you think about renting at all? Or is buying better suited to you? Let’s try to answer those questions. First, let’s look at some important pros and cons for both sides of the argument.

Preparing for Your Move

Researching Neighborhoods and Boroughs

Before making the big move, it's crucial to research NYC's various neighborhoods and boroughs to find the one that best suits your lifestyle and needs. Understanding the best neighborhoods in NYC and the cost of living in New York City will help you make an informed decision.

Overwhelmed by NYC real estate?

Renting in NYC

Renting in NYC offers a unique blend of flexibility and convenience, making it an attractive option for many residents. With various neighborhoods to choose from, renters can experience different parts of the city without long-term commitments. However, understanding the pros and cons of renting and the potential financial implications is crucial for making an informed decision in the ever-evolving NYC rental market.

Pros of Renting

- Flexibility: Renting offers the flexibility to move without the long-term commitment of a mortgage. This is ideal for those who need more clarification on their future plans or are new to the city.

- Lower Upfront Costs: Renting typically requires a security deposit and the first month's rent, whereas buying involves a down payment, closing costs, and other fees.

- No Maintenance Responsibilities: Renters are generally not responsible for major repairs and maintenance, which can save both time and money.

Cons of Renting

- No Equity Building: Monthly rent payments do not contribute to building equity in a property.

- Rent Increases: Rent can increase annually, especially in desirable neighborhoods, impacting long-term financial planning.

- Limited Personalization: Renters often face restrictions on customizing or renovating their living space.

Buying in NYC

Buying a home in NYC is a significant investment with its own rewards and challenges. Homeownership provides stability, potential equity growth, and the freedom to customize your living space. However, it also involves substantial upfront costs and ongoing maintenance responsibilities. It's essential to weigh these factors carefully and use tools like mortgage calculators to assess affordability and long-term benefits.

Pros of Buying

- Equity Building: Monthly mortgage payments contribute to building equity, potentially leading to significant financial gains over time.

- Stability: Owning a home provides stability and can protect against rising rent prices.

- Personalization: Homeowners can renovate and customize their property to their liking.

Cons of Buying

- High Upfront Costs: Buying a home requires a significant upfront investment, including a down payment, closing costs, and other fees.

- Maintenance Responsibilities: Homeowners are responsible for all maintenance and repairs, which can be costly. In a condo or co-op, it is key to understand which of these are borne by the association and which are borne by the owner.

- Market Risk: Real estate values can fluctuate, and there is no guarantee that a property will appreciate in value.

- Common Charges: Homeowners often have to pay common charges in a condo or maintenance fees in a co-op, which typically range between $1,000 - $2,000 per month. These fees can add a substantial amount to the monthly cost of owning a home.

Using Mortgage Calculators to Decide

Mortgage calculators are invaluable tools that help potential buyers understand the financial implications of purchasing a home. Here's how they can assist in making the rent or buy decision in NYC:

1. Estimating Monthly Payments

A mortgage calculator in NYC can help estimate monthly mortgage payments based on the loan amount, interest rate, loan term, and down payment. This allows potential buyers to compare these payments with current rental costs.

2. Understanding Affordability

The NYC home buying calculator can provide insights into how much home you can afford. By inputting your income, debts, and other financial details, you can clearly understand your budget and whether buying a home in NYC is feasible.

3. Comparing Costs Over Time

An NYC rent vs buy calculator can compare the total costs of renting versus buying over a specific period. This includes rent payments, mortgage payments, property taxes, maintenance costs, and potential home appreciation.

4. Evaluating Long-Term Financial Impact

Using an NYC real estate calculator, potential buyers can evaluate the long-term financial impact of homeownership, including tax benefits, equity growth, and potential investment returns.

To put things into perspective, let’s consider a practical example. Suppose you are deciding between renting a one-bedroom apartment in Manhattan for $3,500 per month or buying a similar property worth $1,100,000.

Using an NYC mortgage calculator:

- Down Payment: 20% ($220,000)

- Loan Amount: $880,000

- Interest Rate: 4%

- Loan Term: 30 years

The estimated monthly mortgage payment would be approximately $4,200 (including property taxes and insurance). The monthly rent is higher, but it’s important to consider the long-term benefits of equity building and potential appreciation. By performing these calculations and comparing the figures along with your expectations and hopes, you can arrive at a better decision about renting vs. buying in NYC.

Concluding Remarks

Deciding between renting vs. buying in NYC is a significant financial decision that depends on individual circumstances and long-term goals. While renting offers flexibility and lower upfront costs, buying provides stability and the potential for financial growth. Utilizing tools like the NYC rent vs buy calculator and the mortgage calculator NYC can provide valuable insights and help make an informed decision.

Ultimately, whether you choose to rent or buy, understanding the financial implications and using the right tools will empower you to make the best choice for your future in the vibrant city of New York.